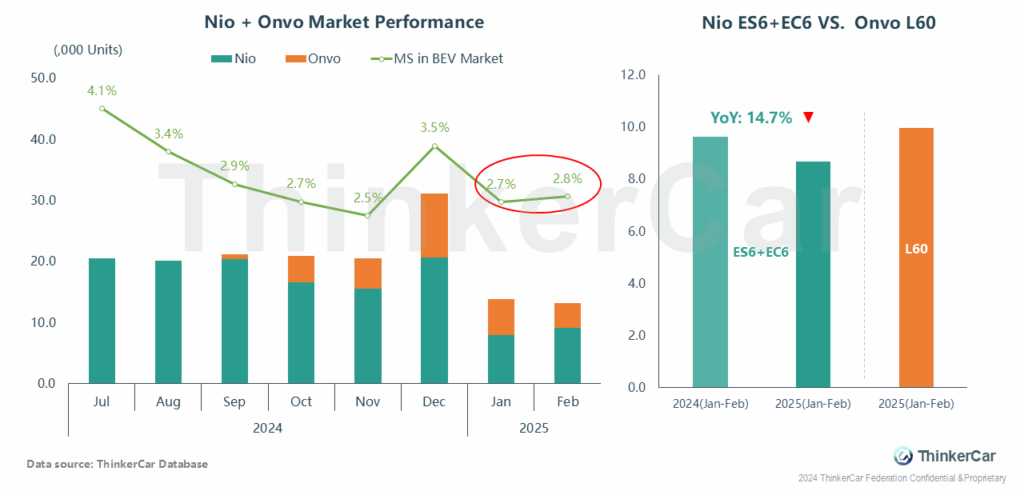

Since the Onvo L60 began deliveries last September, its sales have not brought a qualitative improvement to NIO. In the BEV market, NIO’s market share has dropped from a peak of 4.1% last year to around 2.7-2.8% currently.

NIO’s mainstay models EC6+ES6 also experienced a 14.7% YoY decline in sales during the first two months of this year due to the Onvo L60.

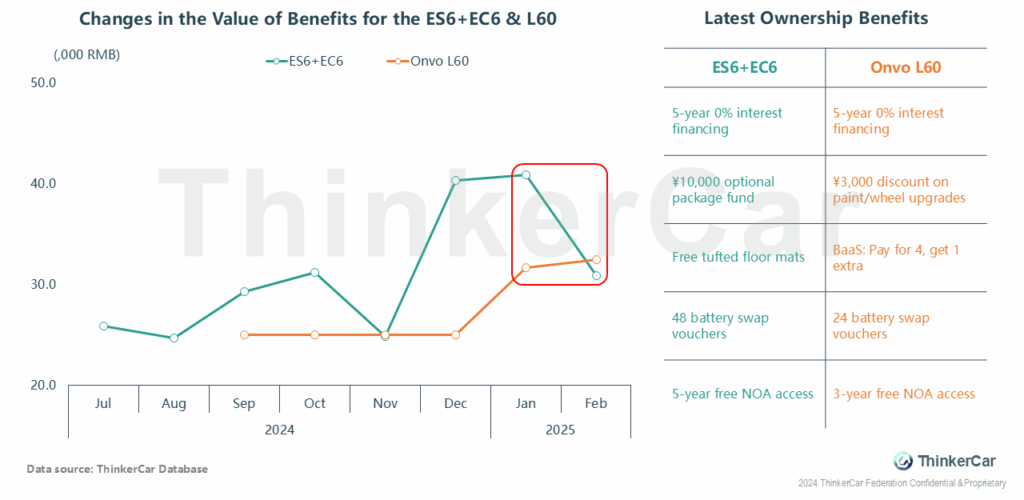

Since H2 2024, NIO’s channel has expanded purchase incentives for ES6/EC6—meanwhile, Onvo’s separate channel added L60 incentives in January 2025. However, the sub-brand’s promotions failed to generate any cross-channel spillover for NIO’s lineup, which is also a disadvantage of the dual-channel strategy.

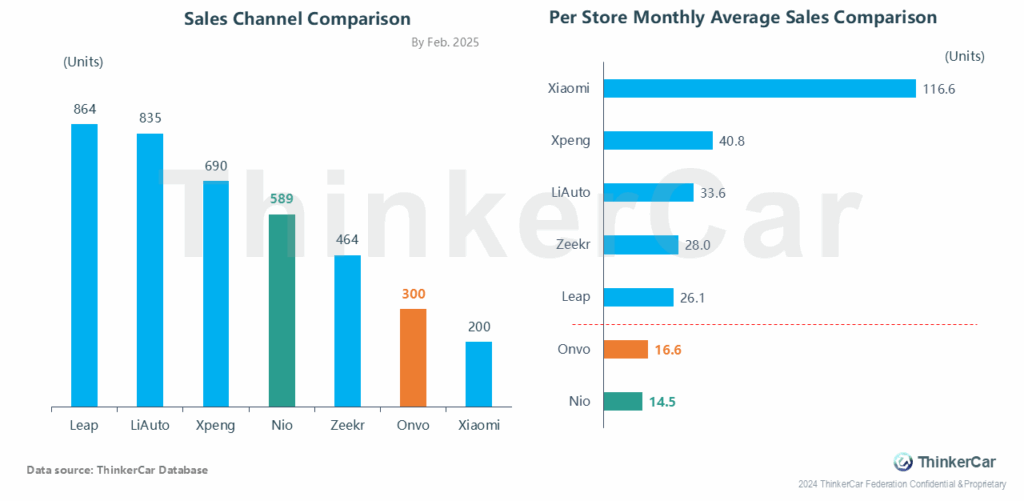

While NIO and its sub-brand Onvo operate separate channel networks (589 vs. 300 stores), their monthly average sales per store—14.5 units for NIO and 16.6 units for Onvo—trail far behind competitors like Li Auto and XPeng. This dual-channel structure makes cross-brand channel integration NIO’s urgent priority.

ThinkerCar Data

chosen by over 200 renowned global enterprises