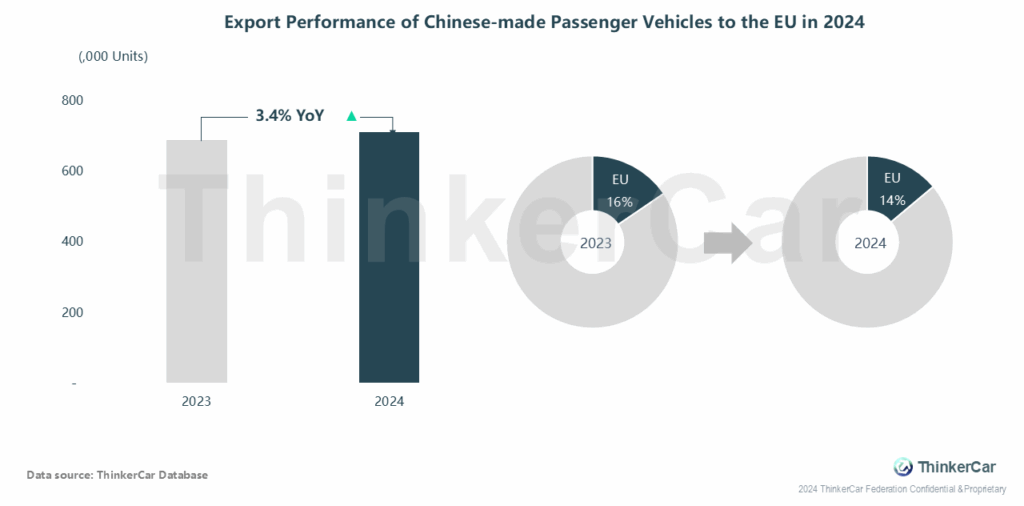

In 2024, approximately 700k Chinese-made passenger vehicles were exported to the EU, a YoY increase of 3.4%. These exports accounted for 14% of China’s total passenger vehicle exports, down 2 pct from 2023.

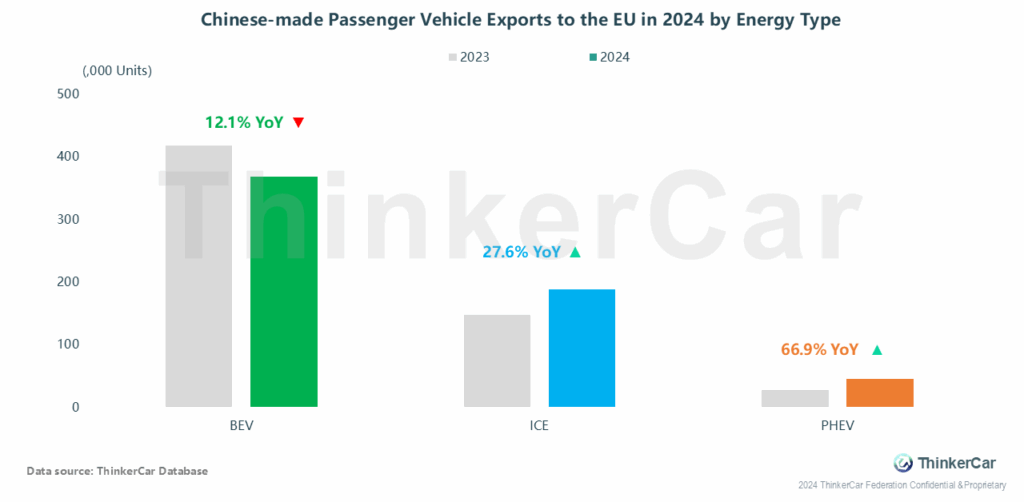

In 2024, although the export volume of Chinese-made BEVs to the EU declined by 12.1% YoY, they remained the main export type. Meanwhile, ICE and PHEV exports increased by 27.6% and 66.9% YoY, respectively.

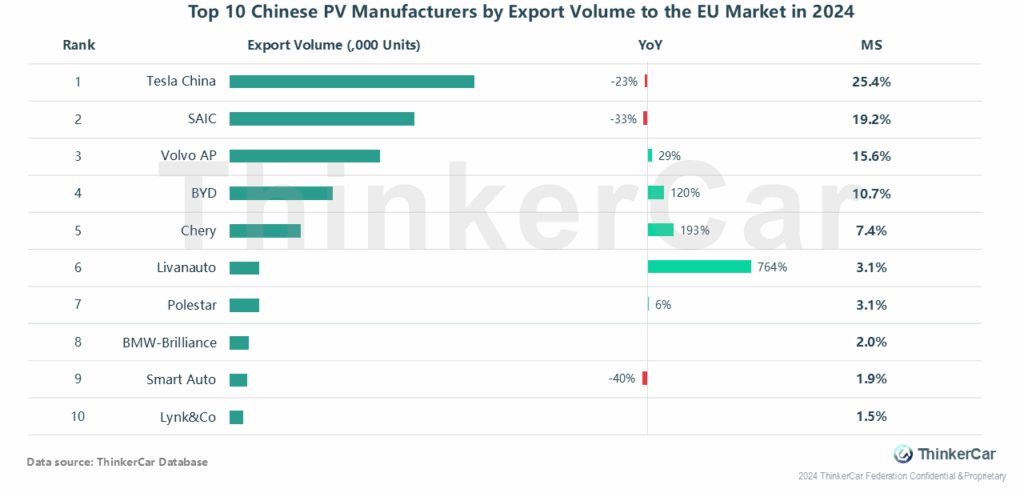

In 2024, Tesla China ranked first in exporting PVs from China to the EU, despite a 23% YoY decline, holding a 25.4% market share. SAIC was second with a 33% drop, while Volvo Asia-Pacific ranked third with a 29% increase. BYD’s growth of 120% allowed it to surpass Chery, claiming the fourth spot with a 10.7% market share.

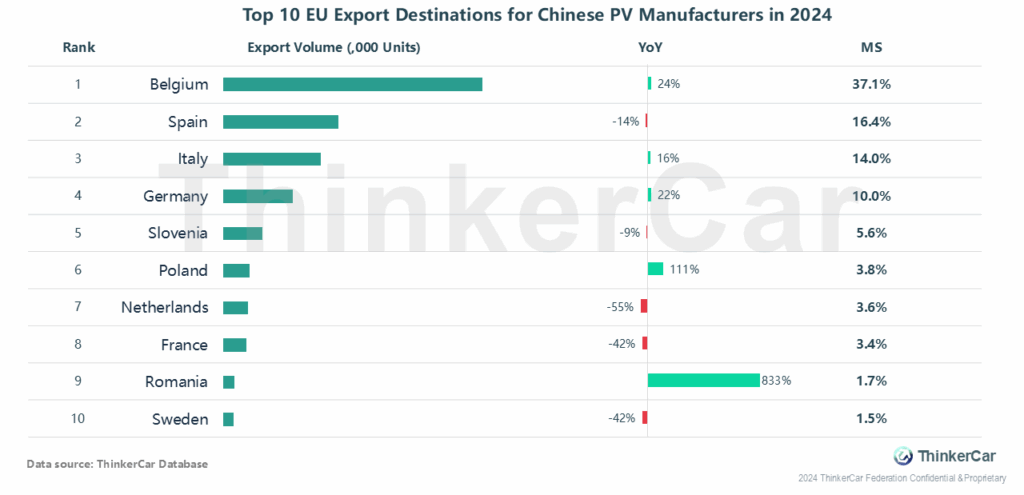

Belgium was the top destination for Chinese PV exports to the EU in 2024, with export volume growing 24% YoY, accounting for 37.1% of total exports. Spain and Italy ranked 2nd and 3rd, with YoY changes of -14% and +16% respectively. Romania was the fastest-growing market, with exports increasing by 833% in 2024.

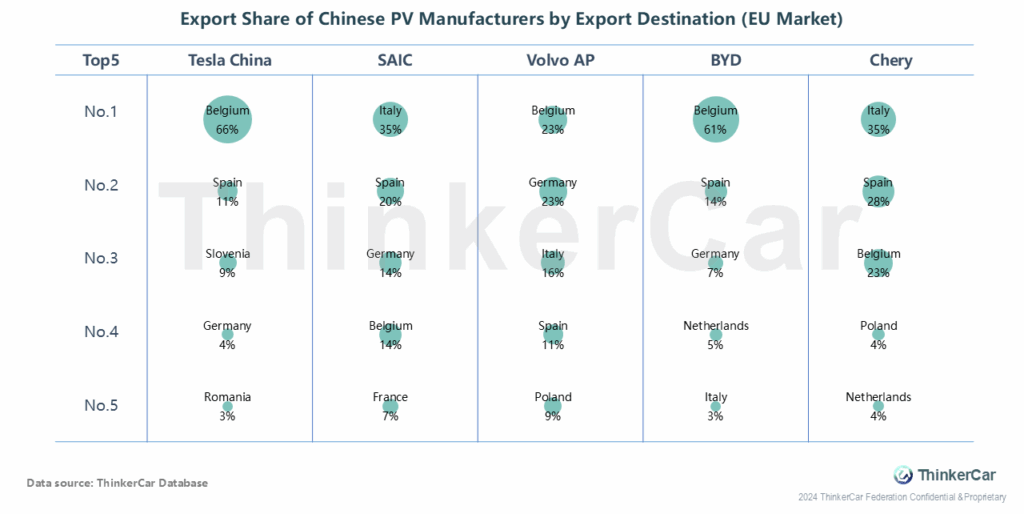

Belgium and Spain are the main destinations for Tesla and BYD exports, accounting for 70% of the share. Meanwhile, SAIC and Chery’s primary export destination in the EU is Italy, followed by Spain.

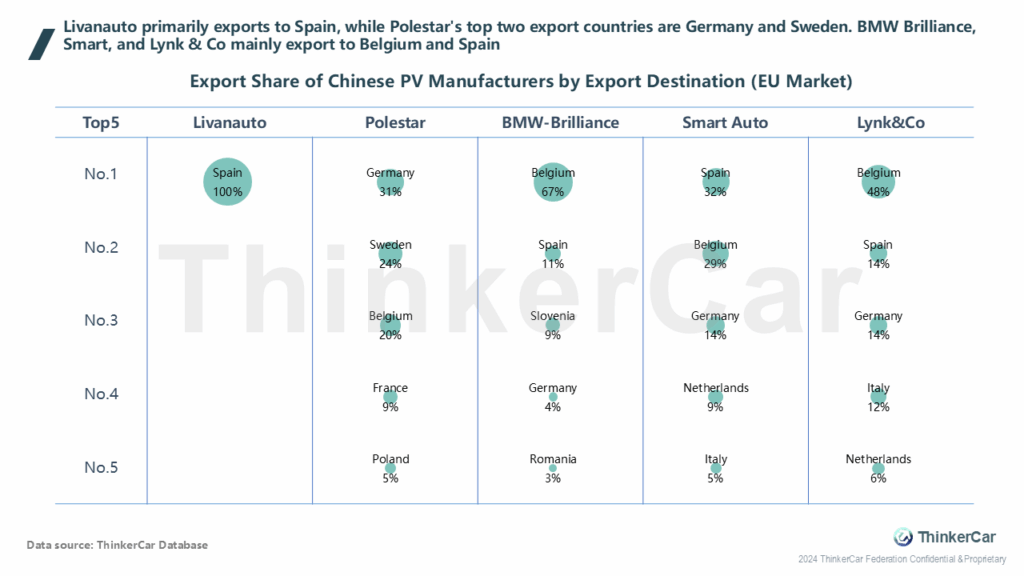

Livanauto primarily exports to Spain, while Polestar’s top two export countries are Germany and Sweden. BMW Brilliance, Smart, and Lynk & Co mainly export to Belgium and Spain.

ThinkerCar Data

chosen by over 200 renowned global enterprises