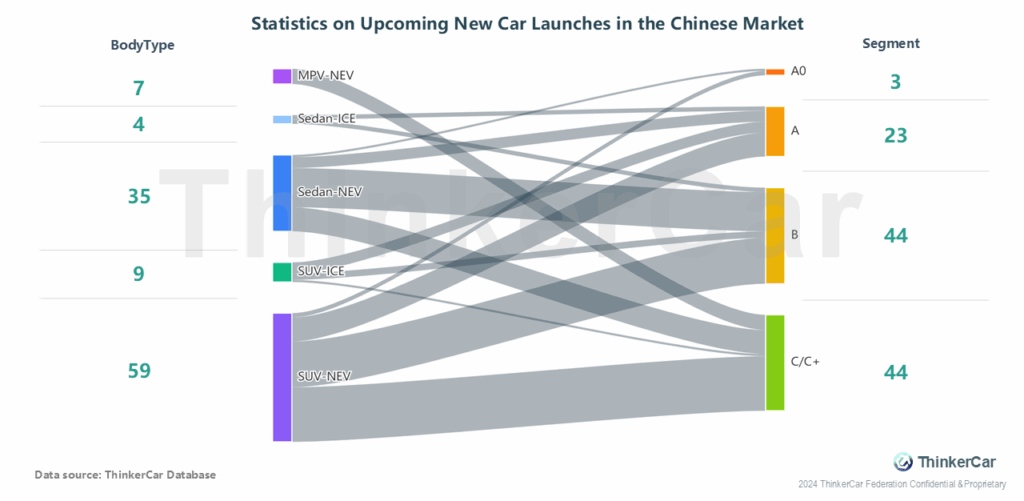

As of May 2025, 114 new vehicles will be launched in the Chinese market. Among them, up to 25 new energy SUVs in the C/C+ segment will be introduced, making it the sub-market with the largest number of model launches.

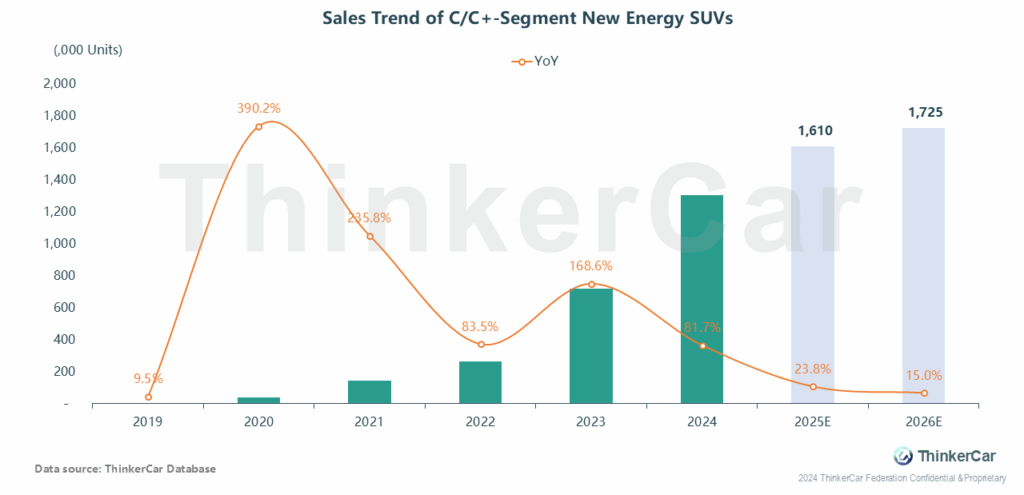

As the proportion of multi – child families in China rises, the demand for interior space and comfort in vehicles has increased significantly. This has also driven the rapid growth of C/C+-segment new energy SUVs. It is expected that the annual sales volume will reach 1.61 million units in 2025 and 1.725 million units in 2026.

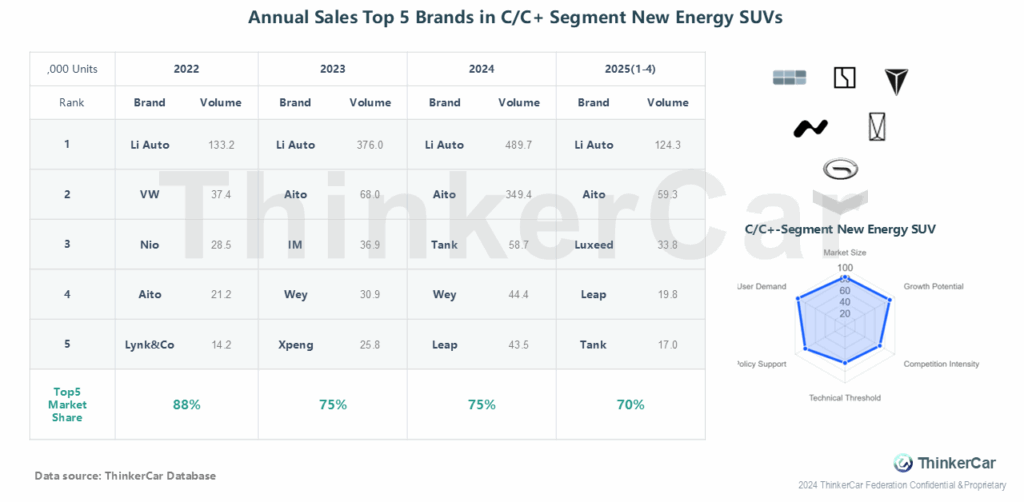

In the new energy SUV market at the C/C+ segment over the years, the top five best-selling brands have always accounted for 70% of the sales; with a large market scale and high growth potential, and relatively less intense competition compared to other market segments, this has attracted brands such as Geely Galaxy, Onvo, and Zeekr to enter this field one after another.

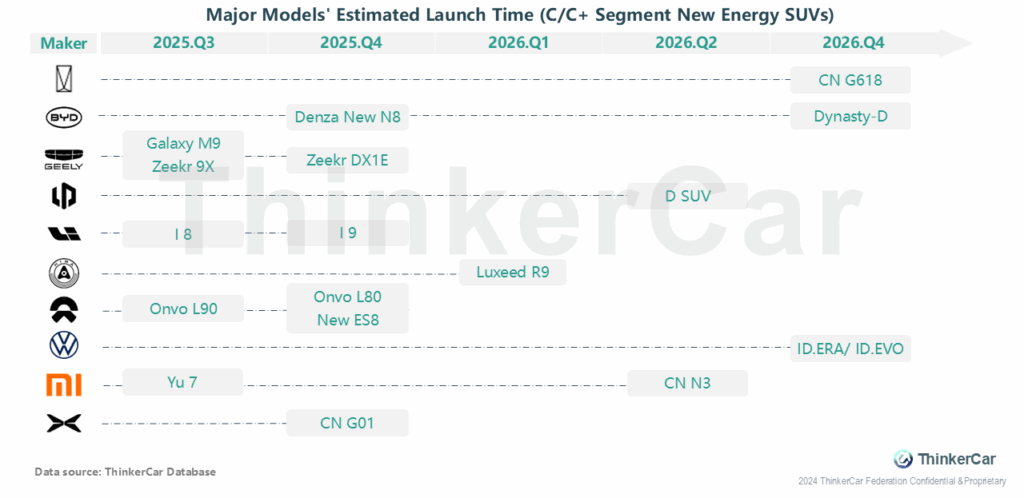

Models such as the Li Auto I8, XPeng G01, and LeDao L80 are scheduled for market launch in the second half of this year, while models like the Volkswagen ID.ERA and BYD Dynasty-D will also enter this segment next year. With the continuous influx of new participants, the market is poised to undergo a profound restructuring.

ThinkerCar Data

chosen by over 200 renowned global enterprises