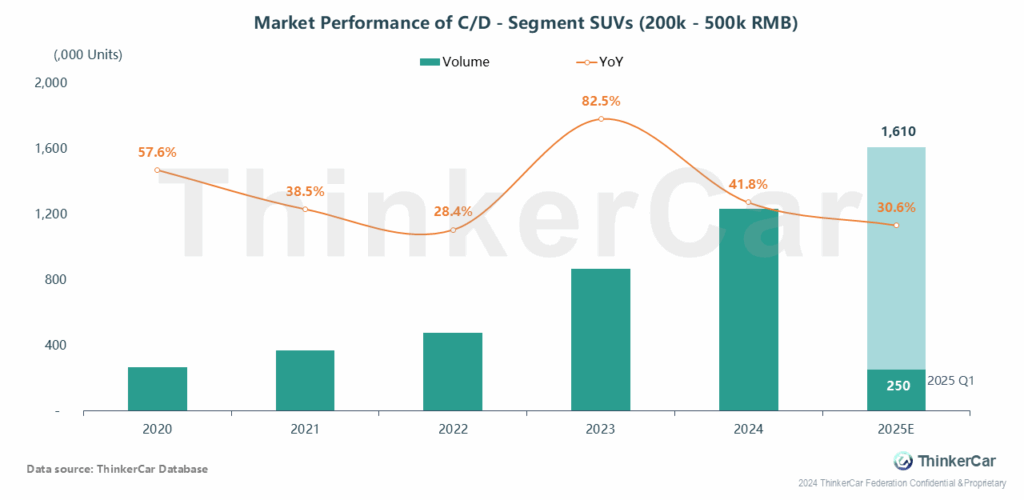

The SUV market in the C/D segment in China has been developing at a rapid pace in recent years, showing a growth rate of more than two digits each year from 2020 to 2024. It is estimated that the total retail volume of this segment’s market will reach 1,610k units in 2025, representing a YoY growth of 30.6%.

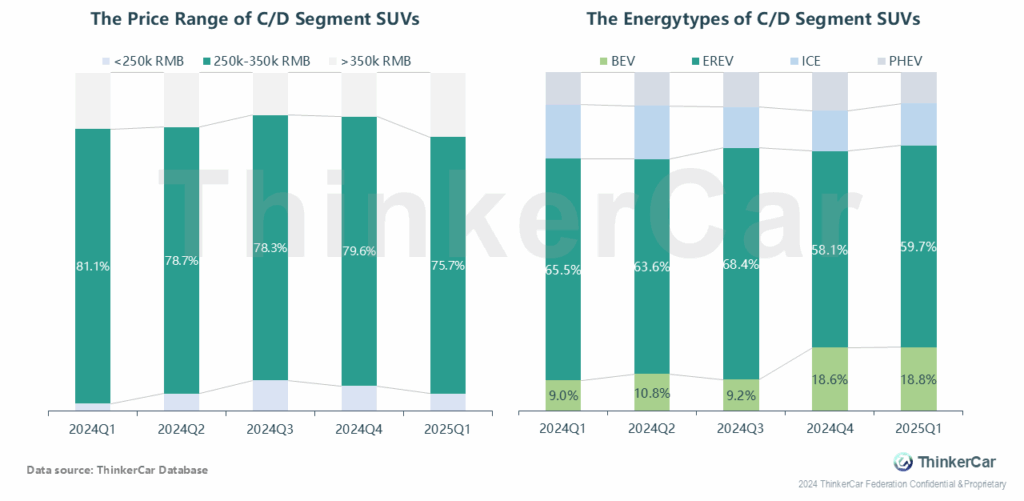

The selling prices of SUV models in the C/D segment market mainly concentrate within the range of 250k to 350k (>70%).

Among them, EREV models represented by Li Auto and AITO account for more than 50% of the market share, while models account for 18% of the share.

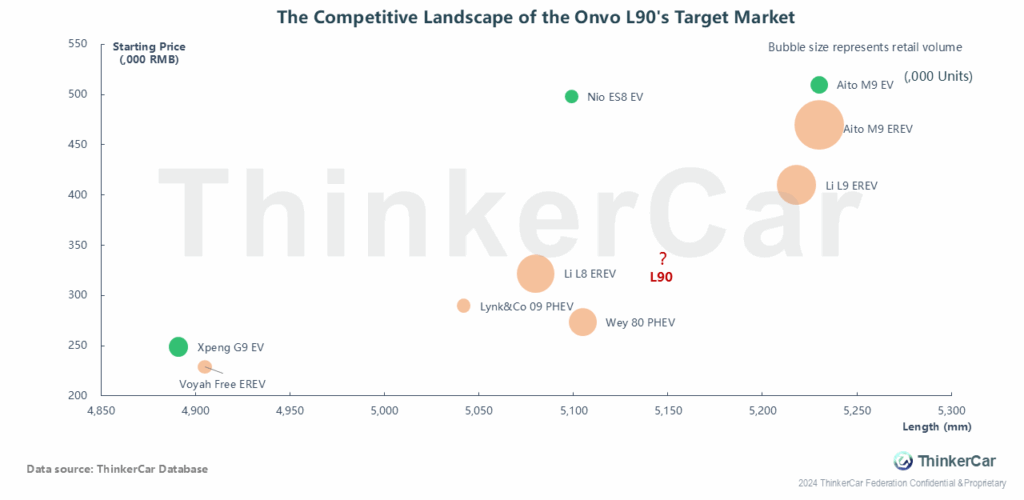

In the main target market of the L90, the AITO M9 EREV and Li L9 EREV hold an absolute dominant position. Among pure electric models, the ES8, NIO’s current flagship SUV, has a starting price as high as 500k RMB, lagging significantly in sales compared to the AITO M9 EV and Xpeng X9 EV. For the L90 to enter this market, the pricing of its products will be crucial.

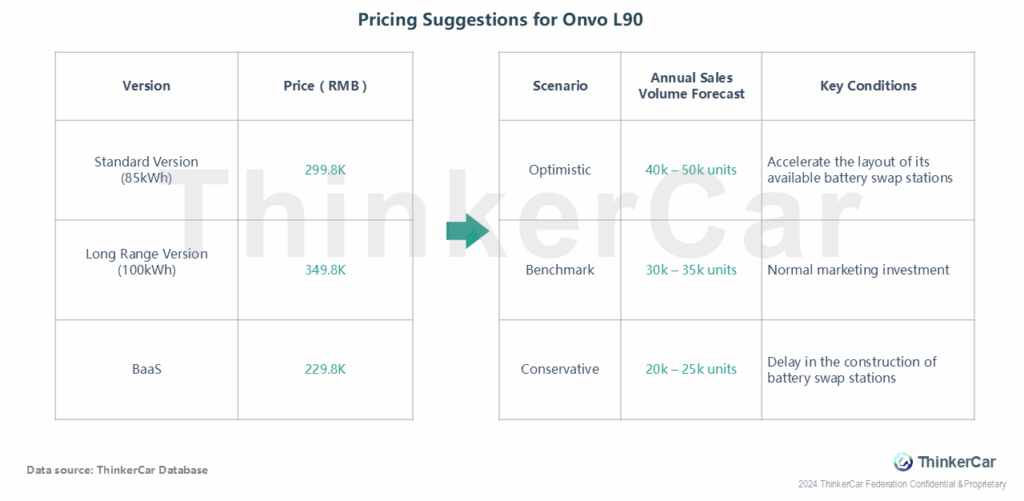

Based on the fact that EREV dominates this niche market and the preliminary simulation of the competitive relationship between ONVO L90 and its competitors, the reasonable pricing range for L90 is 299,800 – 349,800 RMB.

Its annual sales volume benchmark is expected to be 30,000 – 35,000 units, and optimistically, it will reach 40,000 – 50,000 units.

ThinkerCar Data

chosen by over 200 renowned global enterprises