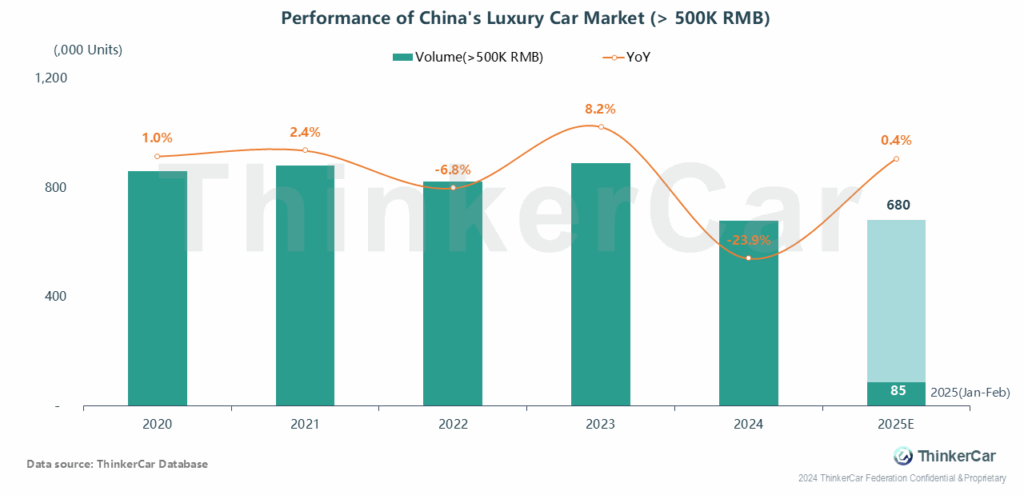

From 2020–2023, 500k+ yuan vehicles’ sales volume stabilized at 850k–890k units, accounting for 4.2%–4.6% market share. 2024 saw a plunge to 677k units due to economic headwinds and consumer retrenchment. Despite China’s 2025 macro targets supporting high-end demand, recovery momentum remains weak. Thus, 2025 sales are estimated to grow 0.4% YoY to 680k units.

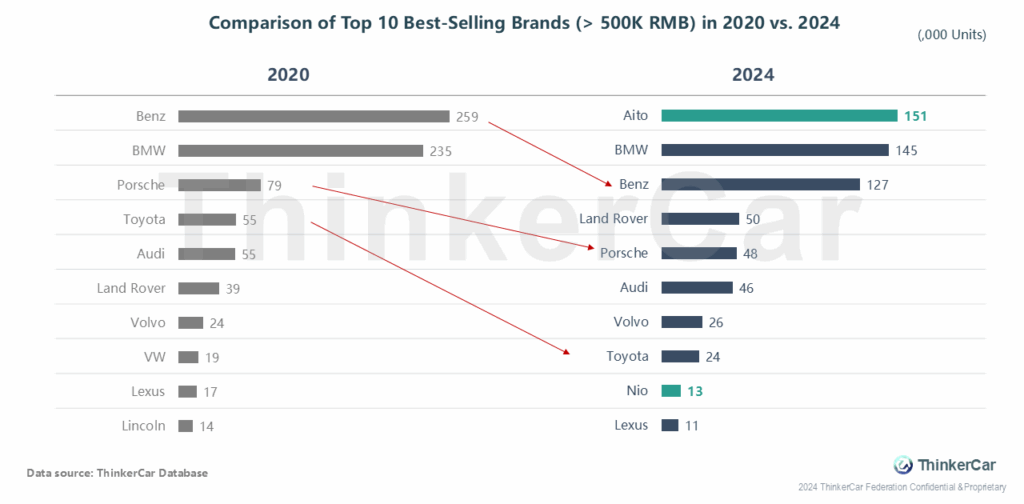

In the >500k RMB segment, compared to 2020 when all top 10 brands were foreign, the market landscape shifted in 2024 as Chinese new car-making brands like AITO and NIO entered the rankings.

Notably, AITO topped the list with 151k units sold annually, breaking the monopoly of BBA in this premium segment.

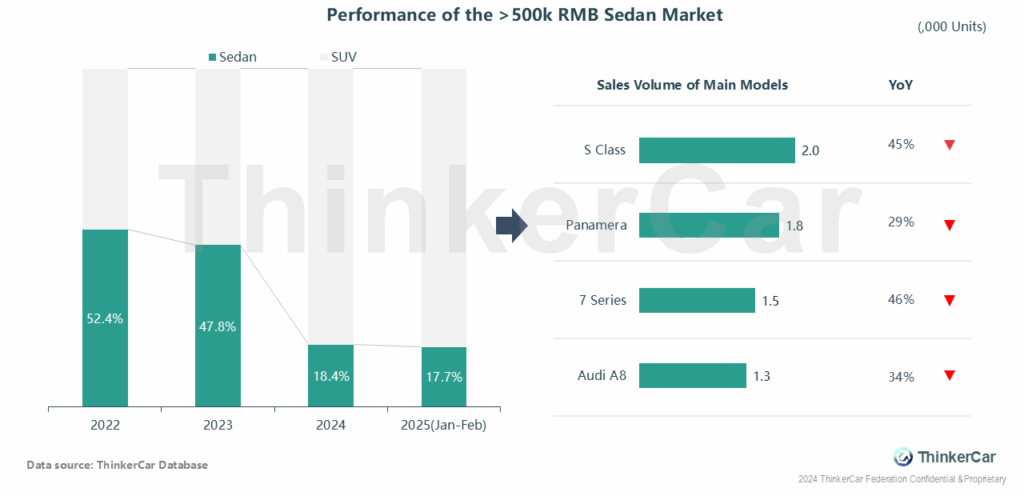

However, in the segment above 500k RMB, the market share of sedans dropped from 52.4% in 2022 to 17.7% in the first two months of 2025. Executive models such as the Mercedes-Benz S-Class and Porsche Panamera have experienced significant declines in sales.

This shift presents both opportunities and challenges for Chinese brands.

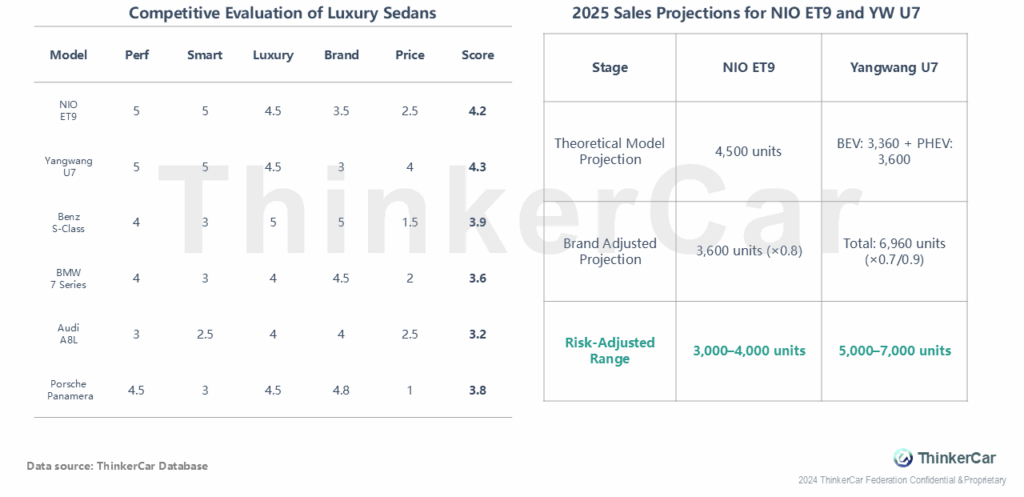

Despite their exceptional performance in comprehensive evaluations, the NIO ET9 and Yangwang U7 face challenges in surpassing the historical legacy of traditional luxury brands like Mercedes-Benz, BMW, and Audi. Considering market dynamics in the luxury segment, their projected 2025 annual sales are estimated at 3k–4k units for the ET9 and 5k–7k units for the U7, balancing their technological strengths against established brand loyalty and market acceptance barriers.

ThinkerCar Data

chosen by over 200 renowned global enterprises