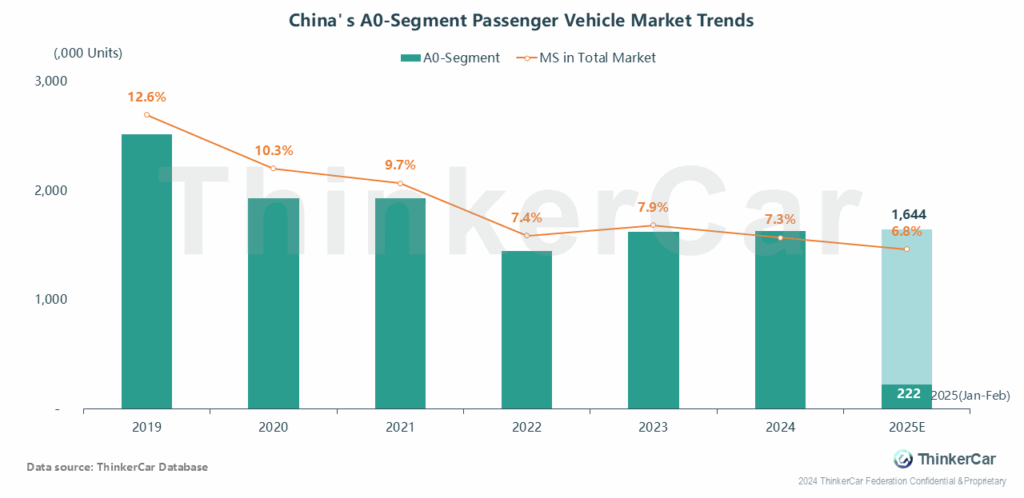

China’s A0-segment PV market has seen flat sales trends in recent years, while its share of the total market continues to decline annually as B+ segments expand rapidly.

Jan-Feb 2025 cumulative sales: 222k Units. Full-year projected sales: 1.644M Units (+1% YoY), with market share dropping to 6.8%.

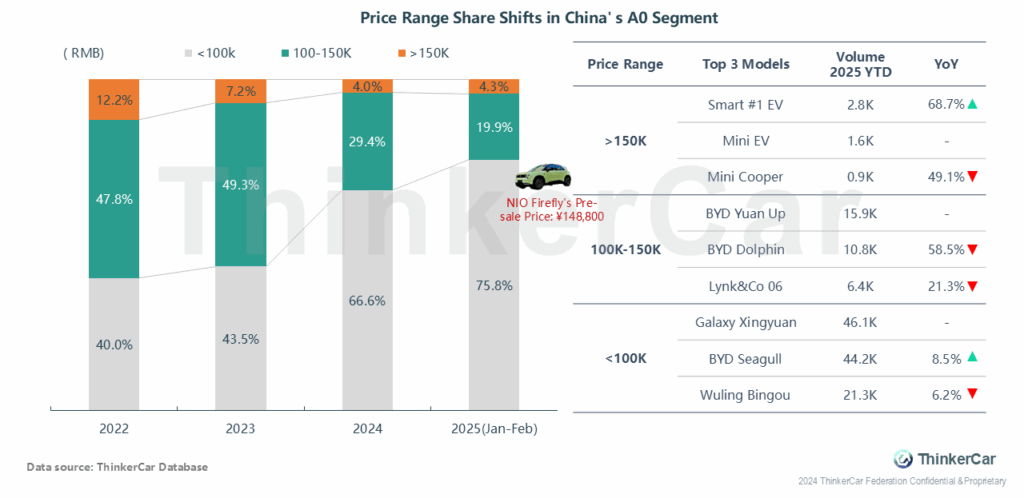

The <100K RMB price range dominates A0 segment sales. In the 100K-150K RMB range where NIO Firefly competes, its market share dropped from 47.8% (2022) to 19.9% (Jan-Feb 2025). Meanwhile, the >150K RMB range saw its share fall to 4.3%, with the top two models (smart#1 and mini EV) selling fewer than 3,000 units combined in the first two months of 2025.

NIO Firefly currently has a pre-sale price of 148,800 yuan, but its performance in the A0 segment has not been particularly strong. The majority of sales in this segment are concentrated below 100,000 yuan, represented by models like the BYD Dolphin and Geely Xingyuan. However, compared to key competitors such as the Smart #1 and Mini EV, the Firefly offers a competitive price advantage.

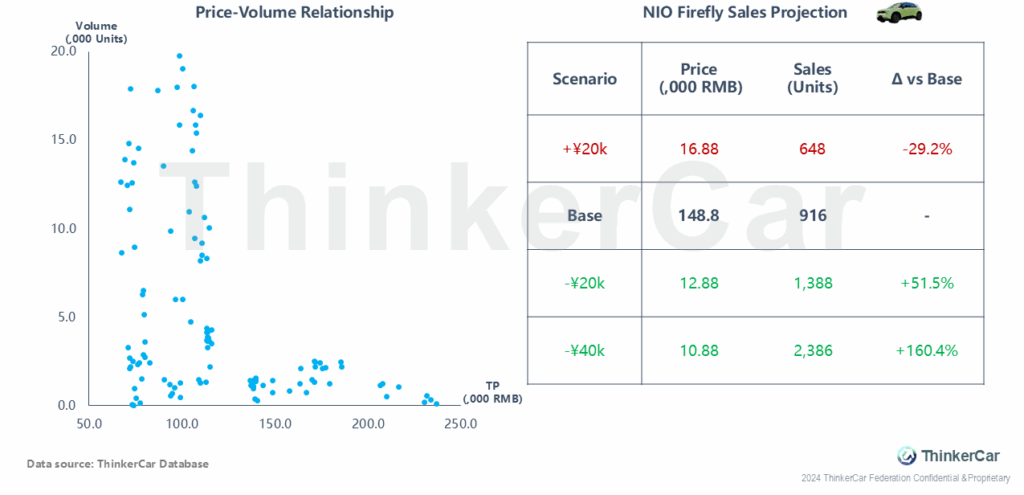

Based on the competitive environment, transaction prices, and sales volume in this segment over the past year, sensitivity analysis simulations show that if NIO Firefly is officially priced at 148,800 yuan, its average monthly sales volume is projected to be approximately 916 units. At a price of 128,800 yuan, monthly sales would rise to 1,388 units, and at 108,800 yuan, the average monthly volume would reach 2,386 units.

ThinkerCar Data

chosen by over 200 renowned global enterprises