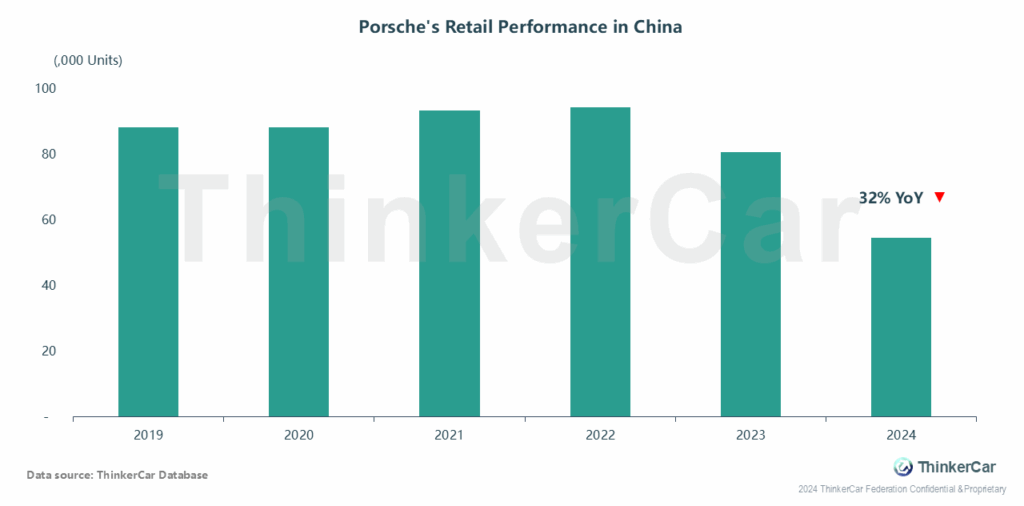

In the current market dominated by new energy vehicles, Porsche’s retail volume in China has declined YoY for two consecutive years, with a further drop of 32% in 2024.

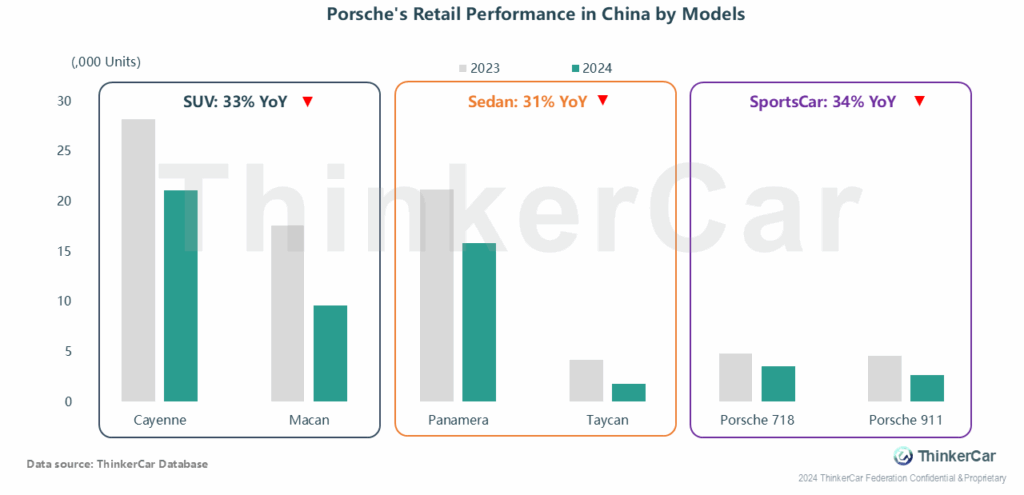

In the Chinese market in 2024, Porsche SUV retail volume declined by 33% YoY, with main model Cayenne dropping by 25%; sedan retail volume fell by 31% YoY; among sportscars, the 718 and 911 declined by 26% and 42% respectively.

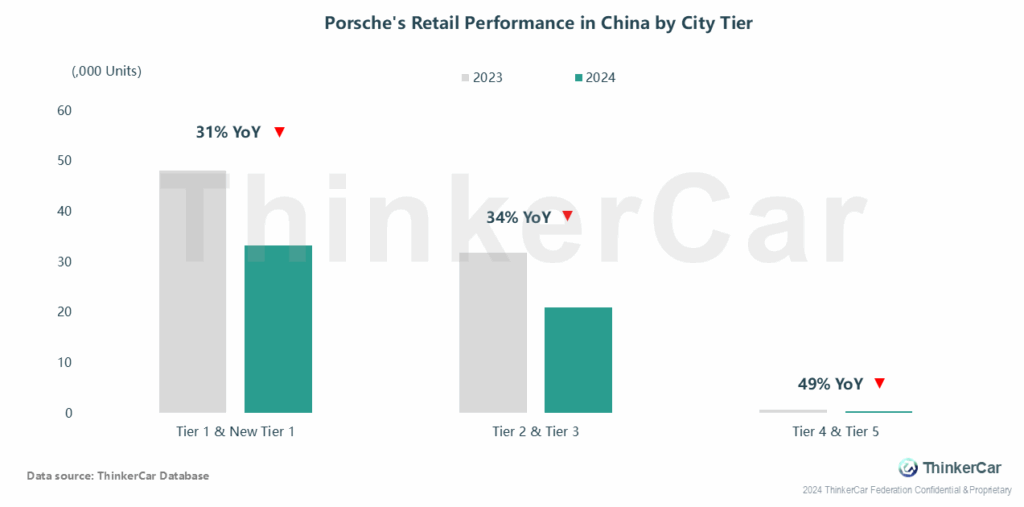

From a city tier perspective, Porsche retail sales in tier 1 & new tier 1 cities declined by 31% YoY, while retail sales in tier 2 & 3 cities declined by 34% YoY.

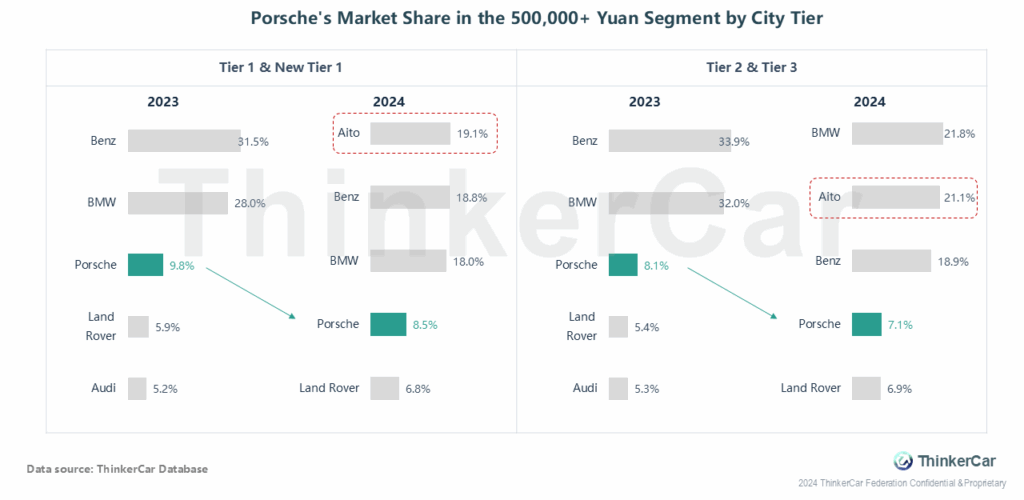

In the 500,000+ yuan segment, Porsche’s share in Tier 1 and New Tier 1 cities dropped from 9.8% in 2023 to 8.5% in 2024, while its share in Tier 2 and Tier 3 cities declined from 8.1% in 2023 to 7.1% in 2024. This indicates that the rise of Huawei AITO is encroaching on the luxury car market, including Porsche.

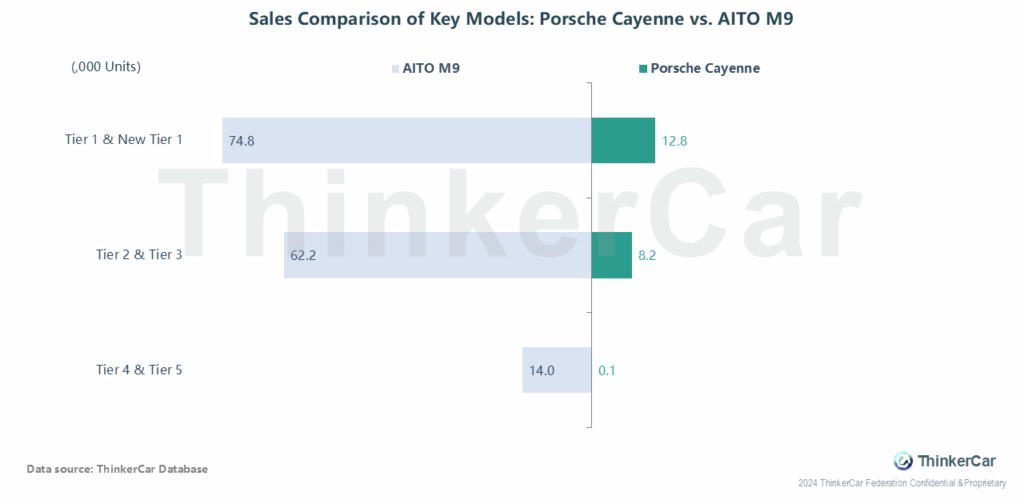

As a direct competitor to the Porsche Cayenne, Huawei’s AITO M9 has completely outperformed the Porsche Cayenne in the retail market thanks to its powerful product capabilities.

ThinkerCar Data

chosen by over 200 renowned global enterprises